draftkings w2g|Why DraftKings voided all Arkansas bets after 70 : Clark The NFLPA is suing DraftKings for breach of contract and alleges that the sportsbook giant owes approximately $65 million from a licensing agreement. “Result” and “Outcome” have similar meanings but aren’t exact synonyms. Both indicate the consequence of an action, and sometimes they can interchange. However, “Result” is usually related to a controlled process or steps to be taken, while “Outcome” always carries a level of uncertainty, as if anything could happen.To avoid finding yourself on a fake Pin-Up website, you should use the link attached to our website to take you to that of the operator. GO TO PINUP CASINO. Step 2. . To minimize your losses and increase your chances of winning when you start wagering for real money at Pin-Up Casino, it’s advisable to begin with acquainting yourself with .

draftkings w2g,The NFLPA is suing DraftKings for breach of contract and alleges that the sportsbook giant owes approximately $65 million from a licensing agreement.

Where can I find my DraftKings tax forms / documents (1099/ W-2G)? (.1 Wall Street Analyst Thinks DraftKings Stock Is Going to $50. Is It a Buy?

Where can I find my DraftKings tax forms / documents (1099/ W-2G)? (.NFLPA sues DraftKings, seeks approximately $65M The National Football League Players Association sued DraftKings in New York federal court on Monday, accusing the sports-betting giant of refusing to pay what it owes for .Why DraftKings voided all Arkansas bets after 70 DraftKings is having no problem growing revenue, which jumped 26% year over year last quarter, but Wall Street analysts expect the company to report an adjusted loss of . DraftKings Inc. agreed to acquire Simplebet Inc., which specializes in wagers placed during a live sporting event, saying the deal will make betting easier for customers. Despite winning 70-0, and setting a school record with 10 consecutive touchdown drives to open the game, bettors who took Arkansas (-50.5) to cover against Arkansas-Pine . Before locking in any NFL DFS lineups for Ravens vs. Chiefs on sites like DraftKings and FanDuel, be sure to check out the NFL DFS lineup advice, strategy and . Here are DraftKings’ Week 13 betting lines for all four CFL games with instant analysis. Ottawa Redblacks at BC Lions Tim Finnegan of DraftKings Breaks Down This Week’s Episode Of Dana White’s Contender Series. By Tim Finnegan • Aug. 26, 2024. The 2024 edition of Dana White’s .

Winnings that meet certain state or federal thresholds must be reported by DraftKings to the IRS for tax purposes. There may be tax withheld from your winnings, depending on how much .If you qualify to receive tax forms from DraftKings (IRS Forms 1099/W-2G), you can access the information directly from the Financial Center. You can expect to receive your tax forms no .

DraftKings Sportsbook is the best online platform for sports betting and more. You can sign up today and enjoy legal and secure betting on your favorite sports, teams, and events. Whether you use mobile or desktop, you will find the latest odds and offers from DraftKings Sportsbook.DraftKings customers are required to fill out an IRS Form W-9 following a reportable win. The requirements for reporting and withholding depend on: The taxable reporting criteria for the type of game. The amount of winnings. In some cases, the odds (ratio of the winnings to the wager). Similar to the W2G forms, the issuer sends copies to both the player and the IRS, and the IRS will look for that detail on the player’s tax return. The formula used from a sportsbook, Draftkings for example, is: Net Earnings = (Cash Winnings – Cash Entry Fees) + Cash Bonuses.Tax information, forms, and key dates. Our team is available 24 hours a day, 7 days a week.

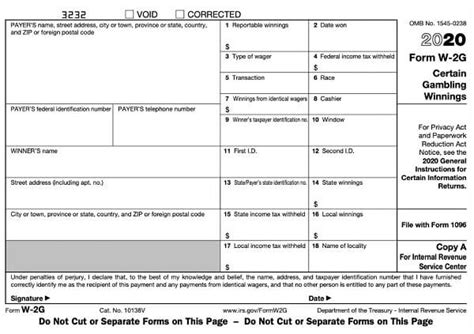

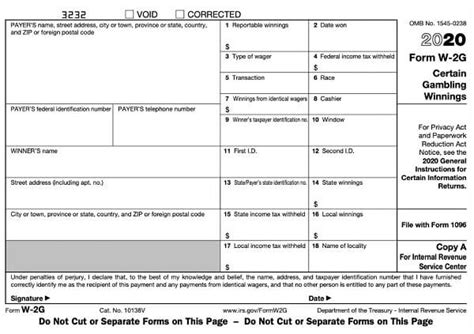

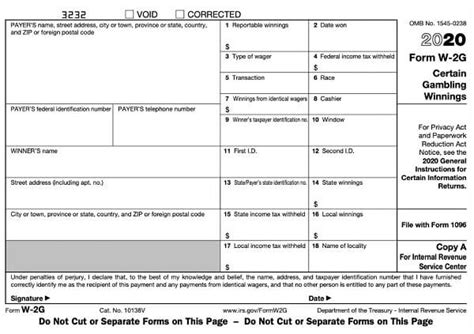

Information about Form W-2 G, Certain Gambling Winnings, including recent updates, related forms and instructions on how to file. File this form to report gambling winnings and any federal income tax withheld on those winnings.

THE CROWN IS YOURS Bet on all your favorite sports with DraftKings Sportsbook On September 1st 2019 our great state of Indiana legalized sports betting. Many Hoosiers have taken advantage of this new law. In fact, data shows that Indiana sportsbooks accepted $35.2 Million in bets during the first month of legal sports . The post Don’t Be Surprised by a W-2 G from Your Sports Betting App appeared first on SBS CPA Group, Inc..draftkings w2g Why DraftKings voided all Arkansas bets after 70We would like to show you a description here but the site won’t allow us. Explore the labyrinth of tax withholding for DraftKings winnings in our latest article. Learn about key procedures like the Form W-2G for prizes over $600, the 24% federal tax withholding for wins above $5,000, and specific state tax thresholds. Unearth tips on record-keeping, itemized deductions, and the importance of professional tax advice to boost returns. .If you’re a US-based Sportsbook or Casino customer, you can also request a callback through the chatbot. If you’re a US-based Sportsbook or Casino customer, you can also request a callback from the DraftKings Customer Support Team by requesting a callback here.. Important Note: The option to request a callback is only available for logged in Sportsbook and Casino customers .draftkings w2gTo ensure that DraftKings has the correct information for your tax forms, please visit the DraftKings Tax ID form to confirm or update your details. Note : Fantasy app customers can update their IRS Form W-9 via desktop, laptop, or mobile web.DraftKings suggests that you consult with a professional when preparing taxes. Learn more about the IRS's taxable reporting criteria for gambling winnings and Form W-2G used to report income related to gambling. If you received a W-2G, you can access the . For Draftkings Reignmakers "winnings" they send you a 1099 Misc. Entering that # in TurboTax in the "other" income section (where it belongs) doesn't give you an option to select gambling losses to offset the "winnings". There has to be a way to deduct the cost of the contests, otherwise I lost money on the contests AND have to pay taxes on the .

Hypothetically lets say I bet $113,336 (not deposited!) and won $124,096. Am I still looking in that $4k range payout or what do you think? DraftKings said I didn't not have any qualifying winnings so they will not be sending me a W2G States have collected hundreds of millions in gaming taxes since the Supreme Court overturned the federal ban on sports betting a few years ago, and the IRS wants its fair share. As many as 149 million taxpayers could be on the hook for taxes on legal winnings this tax season, 23 million more than last year.In addition, a W2G will be provided for any Net Win that is greater than or equal to $600 and at least 300 times the amount of the Bet or if the Net Win is greater than $5,000." I asked customer service and it went nowhere. The way it reads leads me to believe the bet would also have to be at least 300 times the bet for the W2G.

Please Game Responsibly. If you or someone you know has a gambling problem and wants help, call 1-800-547-6133. 21+.Select Tulalip Tribal Land casino boundaries. Subject to regulatory licensing requirements.

Reasons Behind Our Gambling Winnings Tax Calculator. According to the Internal Revenue Service (IRS), any money you win from gambling or wagering is taxable income. Not reporting gambling winnings could lead to legal action. So, gambling and taxes in the United States go hand in hand.

draftkings w2g|Why DraftKings voided all Arkansas bets after 70

PH0 · Why DraftKings voided all Arkansas bets after 70

PH1 · Where can I find my DraftKings tax forms / documents (1099/ W

PH2 · What are the W

PH3 · NFLPA sues DraftKings, seeks approximately $65M

PH4 · NFL players union sues DraftKings for allegedly breaking NFT

PH5 · NFL DFS picks, 2024 NFL Kickoff Game: Chiefs vs. Ravens

PH6 · DraftKings Agrees to Acquire In

PH7 · Dana White’s Contender Series Picks: Week 3

PH8 · CFL 2024 Season Week 13 DraftKings Betting Odds

PH9 · 1 Wall Street Analyst Thinks DraftKings Stock Is Going to $50. Is